Simplification and Accuracy in Texas A&M Farm Bill Decision Tool

As I work with producers and landlords, I’ve seen a variety of understanding and preparation for inputting information into the Texas A&M Farm Bill Decision Tool. Previous blog posts have shared screenshots for inputting information. What I will do with this blog post is share how to simplify the time spent inputting information while checking for accuracy of the information inputted. You will only receive as accurate of information as what you input into the tool!

First, your best friend while inputting is the “eraser sheet” from FSA. It lists CC yields, base acres, reallocated base, but best yet, it lists planted production by year from 2009-2012. That seems to be the largest hang-up I have with producers and getting information to turn out correctly. RMA acre data often includes additional acres that were once pasture or CRP that are now in production but not accounted for in your base acres with FSA. So you have to use FSA production acres in this tool for the information to come out correctly for your farms. It also is a life-saver for farms that are joined together or split out….takes the headache out of figuring planted acres in those years! Note: The above eraser sheet is just an example so you know what one looks like. It is NOT used for inputting or double checking in the next several screen shots.

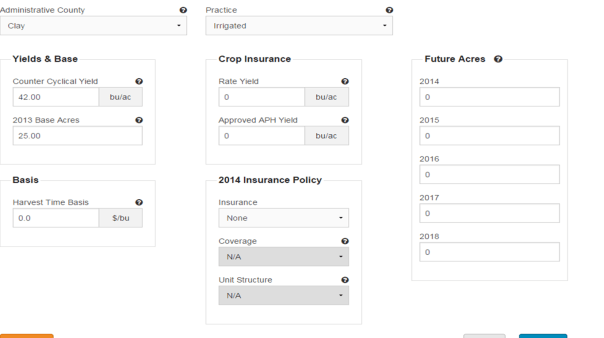

On the “edit” page when entering a farm unit, at the top of the page, you don’t need a description, but can add one if you wish. To simplify and save time on the bottom half of the page: ONLY entering CC yield and base acres for the specific crop saves a great deal of time. You don’t need basis, crop insurance, or insurance policy if you ARE NOT using this tool to make a crop insurance decision. You also only need “future acres” if you are interested in looking at crop insurance, or if you are interested in evaluating ARC-IC as an option. Inputting “0” for future acres just provides a summary of ARC-Co vs. PLC payment projections. Then press “save”.

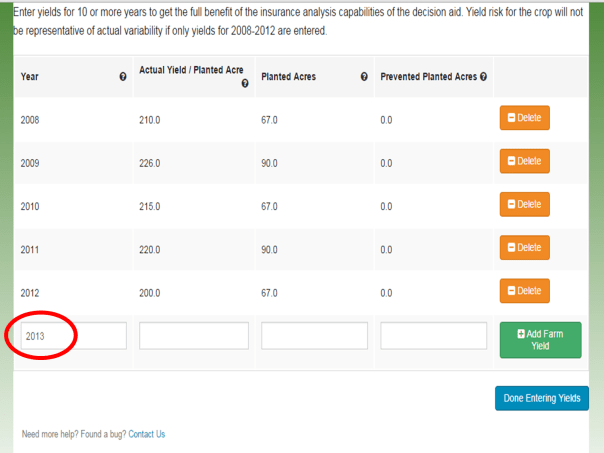

When entering yields, you need to enter one more date after all your yield data has been entered for the data to save properly. In this example, I have inputted yield data for 2008-2012. I then added “2013” and pressed “save yield data”. Not doing this step will delete your last row of yield information. On “planted acres” use production acres from FSA vs. RMA as this provides the correct acres for base reallocation decision and thus, correct potential payments based on those acres. 2008-2012 is necessary to determine updated yield. 2009-2012 acres are needed for determining base reallocation. The acres for 2008 will not influence or throw off the acres in this tool.

For crops in which you have old base acres but you have not produced since 2008, you can enter yields by adding a “0” in them as shown here. This does take time, so you can also skip this step as shown in the next screen shot without affecting your analysis.

UPDATE: If you wish to save additional time, you DON’T have to enter in “0” for yields for old base acre crops you didn’t plant from 2009-2012. Instead, on the home screen, simply hit “save” after entering in old base acres and CC yield for crops you no longer plant and skip entering yields for these crops. The output is the same (Thanks to Randy Pryor, Nebraska Educator in Saline County for this time-saving tip!)

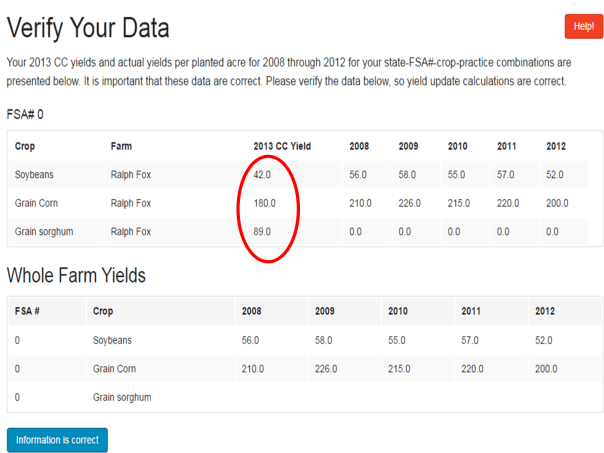

Once all your crop information is entered for every one of your farms, you need to double check your data. First, Click on the “Yield Update” decision tool. The first screen shows what you entered and gives you a chance to check your information. Double check that your CC yields are entered correctly and that the yields look correct for what was entered. If the information is correct, then click on the “information is correct” button. If it is not, click on “home” and go back to the crop and farm where the information needs to be corrected. Note that if you had a crop that did not have CC yield on your FSA sheet because you also had no old base acres for that crop, on the “Home” screen enter “0” for CC yield and “0” for base acres. Then the County plug yield is inserted as the CC yield on this screen.

You will then see the yield updates for all your crops on all your farms that you inputted. You can print this screen for your information. A couple things to look for on this sheet. Whenever the 2013 CC Yield is higher than PLC Yield, it’s probably wise not to change that yield. Also a note for corn in particular, I like to go through all the farms and highlight the farm with the highest PLC corn yield. When having difficulty making a decision between ARC-Co vs. PLC, crops with highest PLC yields will offer the best PLC payments.

Next it’s time to look at the “base reallocation decision tool”. The first screen is a double check for you. It’s very important that the current base acres and reallocation acres match what was given you by the FSA office. Not inputting production acres based on FSA records (shown in top table) can throw off the potential base reallocation in the lower table. If the current base and potential reallocation base agrees with what was provided from FSA, simply push the “information is correct” button. If it doesn’t match, you will need to go back to the home screen and change the production acres so that the total production matches up to total base acres each year from 2009-2012 in order for the base reallocation to be correct. One more note: If you have split irrigated and non-irrigated acres, make sure to take a % of base acres assigned to the crop. (Ex. This farm has a total of 50 corn base acres. If 50% your acres are irrigated corn and you were in a county with split irrigated/non-irrigated opportunity, then assign 25 base acres to irrigated corn on the home screen and 25 base acres to non-irrigated corn). Inputting 50 corn base acres for both irrigated corn and non-irrigated corn would give you a total of 100 base acres which is 50 acres too many and will provide incorrect information.

Next you have an opportunity to select prices. I typically select USDA prices for all crops first. Then hit the “analyze” button. When the following screen appears, I click “download” then print the PDF that appears one-sided. This ensures that information for each farm number does not end up back to back with another farm number if you print two-sided. I then scroll to the bottom of this page, click “change prices” and click all the FAPRI prices, analyze, download, and print one-sided again. It does take some paper, but you’ll see why I recommend this shortly. It also allows you to keep farms separate if you’re showing results to landlords and/or tenants.

Once I print both sets of prices, the gals in my office and I staple together each farm number. We write “high” for FAPRI prices and “low” for USDA prices. I then place the High and Low together by farm number and farm by farm, go through the output with the farmers. Ultimately, I’m looking for trends when both the higher and lower prices agree. In this example, we are first looking at the base acre reallocation decision. Blue bubbles mean higher payments with reallocation; orange means higher payments without reallocation. Look at the bottom line for total payments. Notice in this example that for both low and higher prices, not reallocating the base is consistently higher. To help explain this, look at the base acre information below. What is occurring for this particular farm is a loss of grain base from 132 to 78.5 grain base acres. So essentially for this farm, the increase in corn base acres was not enough to off-set the milo payment from old base. The farmer then has to choose if he/she wants to reallocate base to what is currently planted, or retain base acres to protect grain base and obtain the milo payment. The other thing to notice is the decision of ARC-Co or PLC for each crop and how well they match between high and low prices. In this case, if the farmer chooses no reallocation, PLC is most consistent for milo and corn while ARC-Co is most consistent for soybeans. When both high and lower prices agree like this, it helps make decisions easier. You can always go back and play with the prices more, but you have to be careful with that. Remember, your decision ultimately is based on what you feel future prices will be for the next five years.

The final thing I like to do is analyze the output for higher and lower prices crop by crop, especially for farms where Corn switches decisions on the first page from ARC-Co with FAPRI prices to PLC with USDA prices. It comes down to what the producer feels prices will be the next 5 years. I compare the ARC-Co vs. PLC prices for whichever decision the farmer makes regarding base reallocation. In this example, let’s say the farmer decides to not reallocate his/her acres. We then compare ARC-Co vs. PLC for both FAPRI and USDA prices for each crop. Besides the total payment over the length of the farm bill based on these prices, I also like to compare payments year by year with both options and look at probabilities of those payments based on the projected FAPRI and USDA prices. In this situation, PLC provides higher payments in both higher and lower price situations over the life of the farm bill. ARC-Co provides slightly larger payments the first one or two years depending on price. One thing to keep in mind: If FAPRI prices are correct, then the PLC payments for years 2015-2018 go to $0 because FAPRI is estimating prices above the $3.70 trigger price for corn. So why does the tool show a PLC payment for FAPRI prices? It is taking into account 500 scenarios at one time that all have a chance of occurring in the future and the probability of payment if prices are at, above, or below the predicted FAPRI price for each year. Same for USDA prices. So it’s important to always keep this in mind when analyzing the results.

Hopefully this post was helpful to you in understanding how to simplify your input into this tool, to understand the importance of accuracy, and to understand one way of analyzing data from the Texas A&M Decision tool! You can view more information by checking out these YouTube videos.

Posted on February 1, 2015, in Farm Bill and tagged ARC-Co, farm, farm bill, farm bill tool, farming, plc, Texas A&M farm bill tool. Bookmark the permalink. 2 Comments.

This is EXCELLENT! Thanks!

David, so glad you found this helpful! It doesn’t go into incredible detail of everything to consider on the analysis end, but hopefully it helps ensure more people enter the data correctly to receive a more accurate analysis. Thanks for your comment!